Sending money across borders has always seemed simple on the surface. You type in a few details, hit “send,” and the funds arrive. But behind the scenes, banks and payment providers have long been running complex checks to keep those transfers safe from money laundering and fraud.

Then came crypto. Suddenly, money could move instantly, wallet to wallet, across the globe — often with no names attached and no bank in the middle. What felt like innovation also opened the door to serious risks.

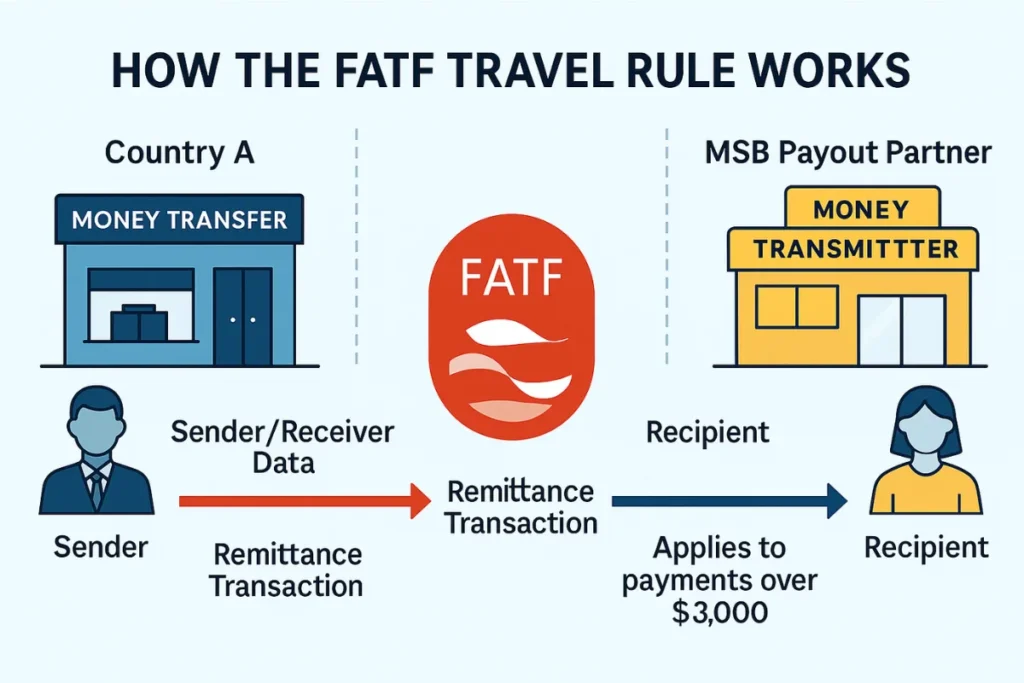

That’s where the FATF Travel Rule comes in. It’s a new global standard designed to bring crypto and digital payments into the same level of transparency and accountability as traditional finance. And in doing so, it’s changing the way money moves around the world.

What Exactly is the FATF Travel Rule?

The Financial Action Task Force (FATF) — the global authority on AML — introduced the Travel Rule to bring crypto transactions closer to the same standards as bank transfers.

Here’s the idea:

Whenever a crypto transaction reaches a certain size, the sender’s and recipient’s details must “travel” with it.

Think of it like mailing a package. You wouldn’t just drop it at the post office without putting your name and the recipient’s address on it. The same logic now applies to moving digital money.

Why It Matters

The Travel Rule may sound technical, but its impact is very real:

More transparency → Wallet addresses alone don’t cut it anymore. Real names and verified details are now required.

Consistency across borders → Whether you’re in New York, London, or Singapore, the same AML expectations apply.

Closing loopholes → Criminals can no longer easily hop between weakly regulated jurisdictions.

Pressure on exchanges → Crypto businesses must build secure systems to collect and share customer information safely.

In short, the way global payments work — and how safe they are — is changing for good.

Where Things Stand Today

Not every country is moving at the same speed, but the trend is clear:

United States → Already applies strict AML obligations through FinCEN.

European Union → With MiCA and new AML regulations, the Travel Rule is becoming law across all member states.

Asia-Pacific → Countries like Singapore, Japan, and South Korea are leading the way with early adoption.

Other regions → Some are still catching up, which can make global transfers more complex.

For businesses operating worldwide, this patchwork means one thing: prepare for the highest standards, no matter where you are.

The Technology Making It Work

Without technology, the Travel Rule would be almost impossible to implement. That’s why we’re seeing new tools emerge to make compliance manageable:

Secure messaging networks that allow exchanges to share customer data privately.

Blockchain analytics platforms that trace suspicious activity across wallets and transactions.

Identity verification solutions that link real people to digital wallets.

These tools don’t just help with compliance — they’re building a payments system that’s safer for everyone.

What the Future Looks Like

Looking ahead, the FATF Travel Rule is set to reshape global payments in several ways:

More global alignment as countries harmonize their rules.

DeFi in the spotlight as regulators start asking how decentralized platforms fit into AML frameworks.

Banks and institutions warming up to crypto once they see strong compliance in place.

Privacy-friendly compliance using advanced tech like zero-knowledge proofs to protect users while meeting regulatory demands.

The Bigger Picture

The FATF Travel Rule isn’t about slowing innovation — it’s about making payments safer, more transparent, and more trustworthy.

For regulators, it closes long-standing gaps in oversight.

For businesses, it presents challenges but also opens doors to credibility and global expansion.

For users, it builds trust in a financial system that is faster, more reliable, and better protected against abuse.

In the bigger picture, the Travel Rule is more than just another compliance requirement. It’s a foundation for the future of global payments — where speed and trust can finally coexist.