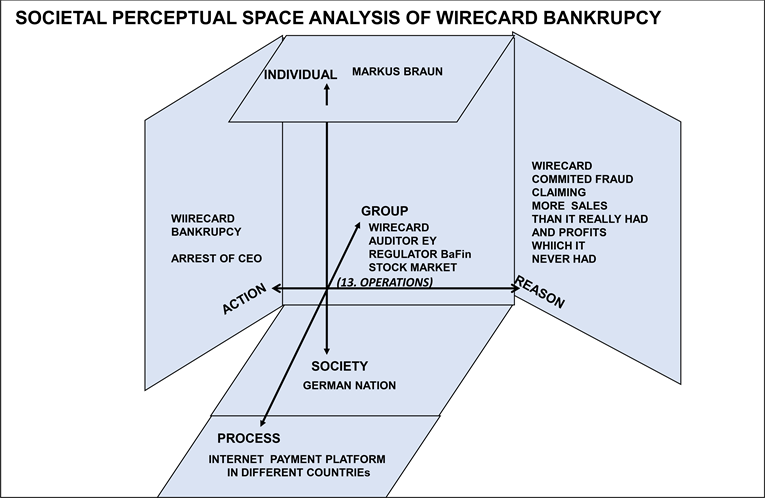

For two decades, Wirecard was Europe’s fintech superstar. A German payments processor that promised to revolutionize digital transactions, it dazzled investors and politicians alike. By 2018, it had climbed into the DAX 30, Germany’s stock market hall of fame — a place reserved for the nation’s biggest and most trusted companies.

To the outside world, Wirecard was untouchable.

But behind the scenes, the story was rotting.

The Rise of a Star

Wirecard began modestly in 1999, helping online shops process credit card payments. By the mid-2000s, it had transformed into a global player, snapping up competitors and pushing aggressively into Asia.

Its founder and CEO, Markus Braun, became the face of European fintech. Dressed in Steve Jobs–style turtlenecks, he pitched Wirecard as the continent’s answer to Silicon Valley’s PayPal. Investors loved it. Politicians praised it. The press called it a symbol of German innovation.

But whispers of fraud were never far away.

Early Red Flags

As early as 2008, journalists and short sellers started asking uncomfortable questions. Why were Wirecard’s profits so unusually high compared to competitors? Why did its growth rely so heavily on obscure third-party partners in far-off markets?

Every time, Wirecard denied the accusations.

Every time, regulators backed the company instead of its critics.

The message was clear: Wirecard was too important to question.

The Big Illusion

What few realized was that Wirecard’s glittering empire was built on phantom profits and fake cash balances.

The company routed much of its supposed revenue through shadowy “partner” companies in Asia. On paper, the numbers looked incredible. In reality, many of these partners barely existed.

Wirecard repeatedly told auditors it held €1.9 billion in trustee accounts in the Philippines. But when the auditors finally demanded direct confirmation from the banks, the answer was simple: the money was never there.

For years, billions in imaginary cash sat proudly on Wirecard’s balance sheet, fooling investors, auditors, and regulators alike.

The Collapse

By June 2020, the truth could no longer be hidden. Wirecard admitted the €1.9 billion was missing — and likely had never existed.

The shock was immediate. Markus Braun was arrested. Shareholders lost everything. Employees found themselves jobless overnight. Germany’s regulators, who had once defended the company, were left scrambling to explain how they missed one of the biggest corporate frauds in history.

The fintech darling had become Europe’s financial nightmare.

What We Can Learn

Wirecard’s downfall isn’t just a corporate scandal — it’s a cautionary tale for every business.

Numbers must be proven, not assumed. Audits without verification are meaningless.

Silencing critics only delays the truth. Whistleblowers and investigative journalists often see what insiders miss.

Culture is everything. A company that prizes growth over integrity creates space for deception.

Complexity hides risk. Global webs of subsidiaries and third parties are fertile ground for fraud.

Why It Still Matters

Wirecard wasn’t supposed to fail. It wasn’t a small startup cutting corners — it was a giant, celebrated as a symbol of Europe’s financial future. And that’s exactly why its collapse sent shockwaves through global markets.

Out of the rubble came reform: Germany reshaped its financial watchdog, and the EU toughened rules around AML, fraud, and fintech oversight.

For today’s startups, the lesson couldn’t be clearer: weak controls may buy time, but they always come due.

Because in finance, trust is the real currency.

And once it’s spent, you can’t get it back.