Artificial Intelligence (AI) is no longer something you read about in research papers — it’s here, and it’s changing how banks, fintech’s, and crypto firms fight fraud and money laundering.

The challenge is simple: financial crime is getting smarter. Criminals are no longer just moving large suspicious transfers — they’re breaking payments into smaller pieces, using crypto mixers, or hiding behind fake identities. Traditional systems can only go so far.

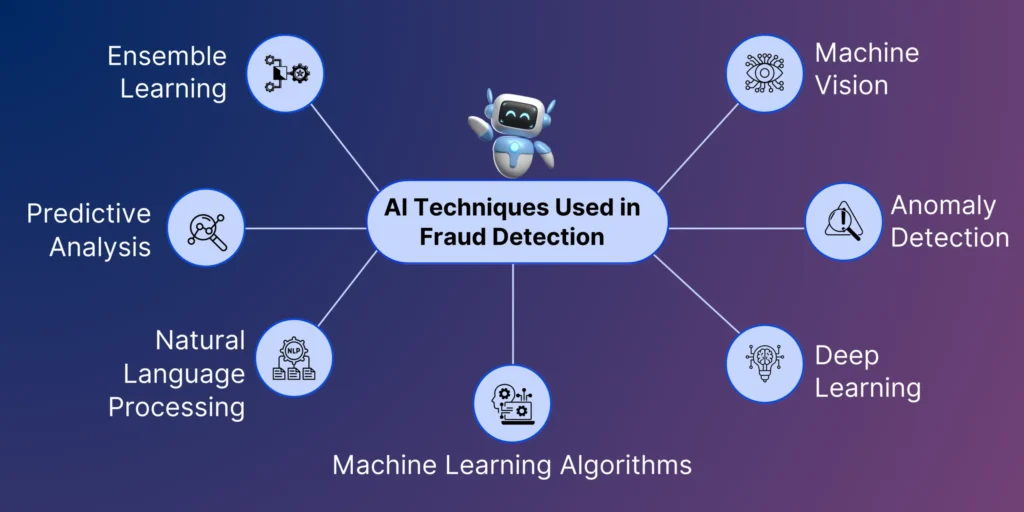

This is where AI steps in. Unlike old rules-based systems that say, “flag anything above $10,000,” AI can actually learn patterns, spot unusual activity in real time, and cut down on the endless false alarms compliance teams deal with.

Why AI Matters in AML

Old systems = static rules.

AI systems = adaptive, learning tools.

That difference is huge. For example:

A traditional system might flag every international transfer over a certain amount (leading to thousands of false alerts).

An AI system looks at context — who the customer is, their usual behaviour, and what’s normal for their peer group.

The result? Fewer false positives, faster investigations, and better detection of real fraud.

Where AI is Being Used Right Now

Transaction Monitoring

AI looks at flows of money in real time, spotting unusual patterns that a static system would miss.

Customer Risk Profiling

Instead of setting risk levels once at onboarding, AI adjusts risk continuously based on customer behaviour.

Identity Verification (KYC)

From biometrics to document scans, AI helps spot fake or manipulated IDs instantly.

Reducing False Positives

AI prioritizes alerts, so compliance teams focus on the riskiest cases instead of drowning in noise.

Sanctions & Media Screening

AI-powered language tools scan global news, databases, and watchlists in seconds, flagging risks quickly.

The Catch: Challenges with AI

Of course, it’s not all smooth sailing. AI brings its own issues:

Explainability: Regulators don’t like “black box” systems. Firms must show how an AI reached its conclusion.

Bias: Bad training data = biased results. Garbage in, garbage out.

Costs: Advanced AI can be expensive. Smaller firms may need RegTech partners.

Evolving Rules: Regulators (FATF, FinCEN, EU) are still shaping AI guidelines. Firms need to stay flexible.

What Regulators Are Saying

The global message is clear: AI is welcome, but accountability is non-negotiable.

FATF: Innovation is good, but models must be explainable.

FinCEN (U.S.): AI can help, but humans must stay in the loop.

EU: Under new AML laws, AI in compliance will be treated as “high risk” — meaning stricter oversight.

UK FCA: Encourages AI use but warns that firms must document training data and governance.

Banks vs. Crypto: Two Different Worlds

- Banks

- Use AI to upgrade old systems and cut false positives.

- Already under heavy regulation, so explainability is key.

- Crypto Firms

- Rely on AI to unmask pseudonymous wallets and track suspicious blockchain flows.

- In crypto, AI isn’t just a nice-to-have — it’s survival.

In short: banks use AI to optimize, crypto firms use AI to prove.

Real-World Examples

HSBC cut false positives by 60% after adopting AI.

PayPal uses AI to scan billions of daily transactions while keeping legitimate payments smooth.

Chainalysis & Elliptic use AI to help crypto firms spot risky wallets.

BitMEX (2020) was fined $100M for weak AML monitoring — regulators stressed that stronger, AI-style tools could have prevented it.

Binance (2023) paid $4.3B in penalties for AML failures. The case highlighted why advanced monitoring tools are now expected, not optional.

These cases underline a simple truth: outdated systems = big fines. AI-driven systems = stronger compliance and trust.

What’s Coming Next

Over the next five years, AI in AML will go from optional to standard. Expect:

Generative AI in compliance — helping draft SARs or summarize huge datasets.

AI + blockchain analytics — better tracing of crypto flows through mixers and DeFi.

Regulators tightening rules — especially around explainability and fairness.

AI for regulators themselves — using SupTech to monitor risks at industry scale.

Accessibility for smaller firms — cloud-based AI tools that don’t need big in-house teams.

What It All Comes Down To

AI isn’t here to replace compliance teams — it’s here to make them smarter. Machines can crunch the data, but humans still provide judgment, ethics, and accountability.

The future of AML will be defined by this partnership: AI for scale and speed, humans for oversight and decision-making.

Firms that adopt AI responsibly won’t just stay compliant — they’ll build trust, efficiency, and a real competitive edge.