For decades, anti-money laundering (AML) compliance meant manual checks, endless paperwork, and slow investigations. Compliance teams spent hours verifying customer identities, cross-checking sanctions lists, and reviewing transactions one by one.

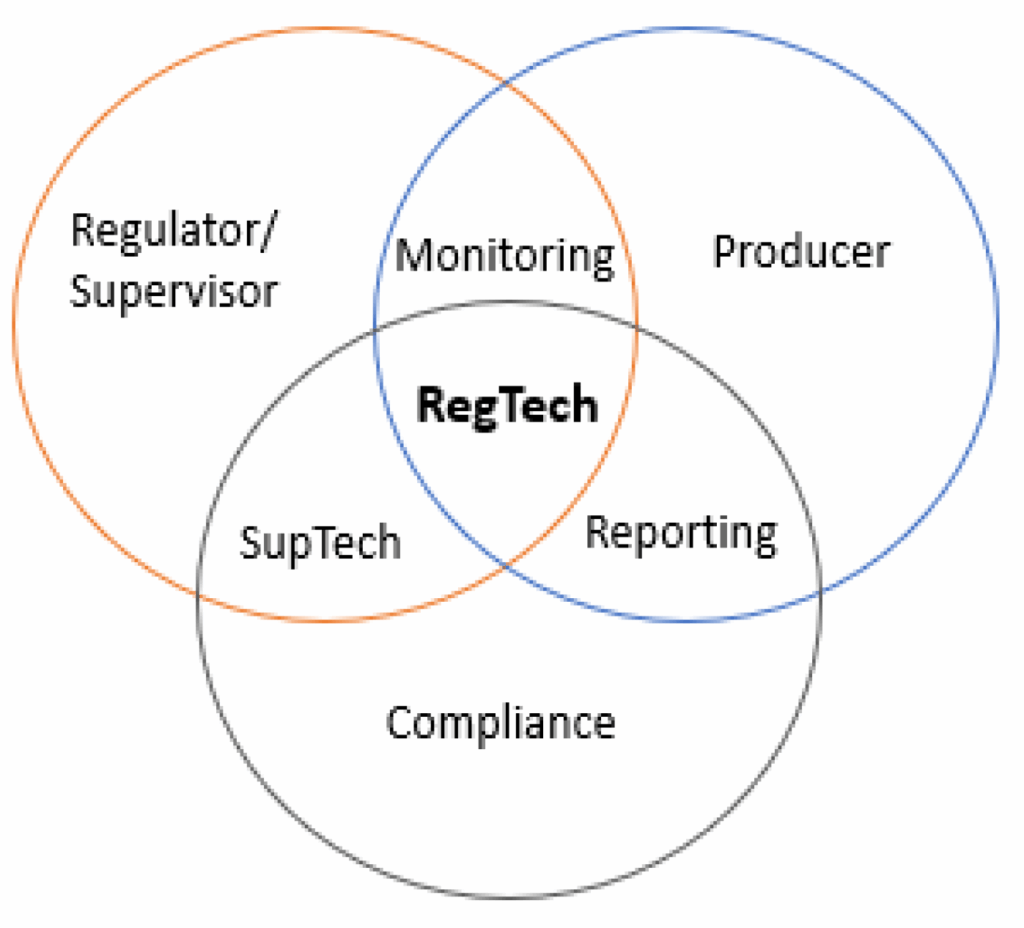

But the pace of financial crime — and the growing expectations of regulators — quickly outgrew those methods. Today, the answer lies in RegTech (regulatory technology): advanced tools that combine AI, machine learning, and automation to make AML faster, smarter, and more effective.

This shift isn’t just a trend. It’s a fundamental transformation in how the financial system defends itself.

What Is RegTech?

RegTech is technology designed to help businesses meet regulatory requirements more efficiently. In the AML context, RegTech tools are used to:

KYC and onboarding → Automate customer due diligence (CDD), PEP, and sanctions screening.

Transaction monitoring → Flag unusual or high-risk behaviour in real time.

Case management → Centralize compliance workflows, making investigations more efficient.

Regulatory reporting → Automatically generate Suspicious Activity Reports (SARs) and ensure deadlines are met.

In short: RegTech bridges the gap between compliance obligations and modern technology.

The Core Technologies Behind RegTech

- Artificial Intelligence (AI)

AI can analyse millions of transactions instantly, detecting patterns too complex for humans to spot. For example:

Customers who structure deposits just below reporting thresholds.

Rapid transfers across multiple accounts that may indicate layering.

Networks of accounts connected in ways that suggest organized crime.

- Machine Learning (ML)

ML systems learn from past cases. When compliance officers mark alerts as false positives or true risks, the system improves — reducing noise and surfacing higher-quality alerts over time.

This is critical, because traditional systems can generate 95% false positives — overwhelming teams and wasting resources.

- Automation

Automation eliminates repetitive tasks:

- Screening new customers against sanctions lists.

- Updating risk scores as new data arrives.

- Preparing compliance reports.

This lets compliance officers focus on investigation and decision-making, instead of chasing paperwork.

Traditional AML vs. RegTech: A Clear Difference

Traditional AML programs often feel slow, manual, and reactive. Take onboarding for example: compliance officers used to spend hours checking IDs, verifying documents, and manually screening customers against sanctions lists. Mistakes or delays were common.

With RegTech, the process looks entirely different. Customer onboarding can be automated with biometric checks, real-time database screenings, and instant verification. What once took days now takes minutes — without sacrificing accuracy.

The same is true for transaction monitoring. Legacy systems are rule-based, meaning they generate thousands of alerts, most of which are false positives. Teams end up drowning in noise, reviewing cases that lead nowhere. RegTech solutions, powered by AI and machine learning, actually learn from past cases, dramatically reducing false positives and surfacing the activity that truly matters.

Investigations and reporting also shift from painful to efficient. Instead of juggling emails and spreadsheets, RegTech platforms give compliance officers centralized dashboards, automated alerts, and ready-to-file Suspicious Activity Reports (SARs). Not only does this save time, it strengthens the overall audit trail regulators expect.

And when it comes to scaling a business, the contrast is even sharper. Traditional compliance struggles to keep up with growth — more customers usually mean more staff. RegTech, on the other hand, scales seamlessly. Whether you’re onboarding 100 clients or 100,000, automation keeps the process smooth without ballooning costs.

Perhaps the biggest difference? Agility. Old systems require constant manual updates whenever regulations change. RegTech platforms are designed to stay up to date automatically, helping businesses remain compliant across multiple jurisdictions without starting from scratch every time.

In short: traditional AML is reactive and resource-heavy, while RegTech makes compliance proactive, scalable, and intelligent.

Why RegTech Matters Now

The rise of RegTech is no accident. Several forces are driving adoption worldwide:

Rising fines and penalties → Global AML fines reached $5B+ in 2022 alone, with individual penalties hitting billions (e.g., Danske Bank, Binance).

Tougher regulations → The EU’s AML package, the U.S. AMLA 2020 Act, and FATF guidelines are raising the bar.

Explosion of digital finance → Fintech, crypto, and instant payments make traditional manual monitoring impossible.

Regulatory pressure on efficiency → Supervisors expect firms not only to comply, but to show evidence of strong monitoring systems.

Without RegTech, compliance teams risk falling behind — both operationally and legally.

Real-World Adoption

Major banks (HSBC, JPMorgan, ING) are using AI-driven transaction monitoring to cut down false positives by 20–30%.

FinTech’s and startups use RegTech vendors (like ComplyAdvantage, Fenergo, or Onfido) to build scalable compliance from day one.

Crypto exchanges increasingly rely on blockchain analytics providers (Chainalysis, Elliptic, TRM Labs) for on-chain AML monitoring.

These aren’t “nice to haves” anymore — they’re becoming baseline expectations.

The Future of RegTech

RegTech is only getting started. The next wave will bring:

Predictive AML → Systems that flag risks before suspicious activity occurs.

Blockchain-native tools → Real-time crypto monitoring across chains and DeFi platforms.

Explainable AI (XAI) → Models that show regulators why a decision was made, increasing trust in automated systems.

Integrated global standards → Tools that adapt automatically to evolving AML laws across multiple jurisdictions.

What It All Means

The rise of RegTech is reshaping AML from a manual, reactive process into a data-driven, proactive defence system.

For startups, it levels the playing field: you don’t need the resources of a global bank to run a world-class compliance program. For established institutions, it’s the only way to keep pace with regulators and criminals alike.

AML is no longer just about ticking boxes.

It’s about building resilience, trust, and intelligence into the heart of financial services.

And with RegTech, that future is already here.